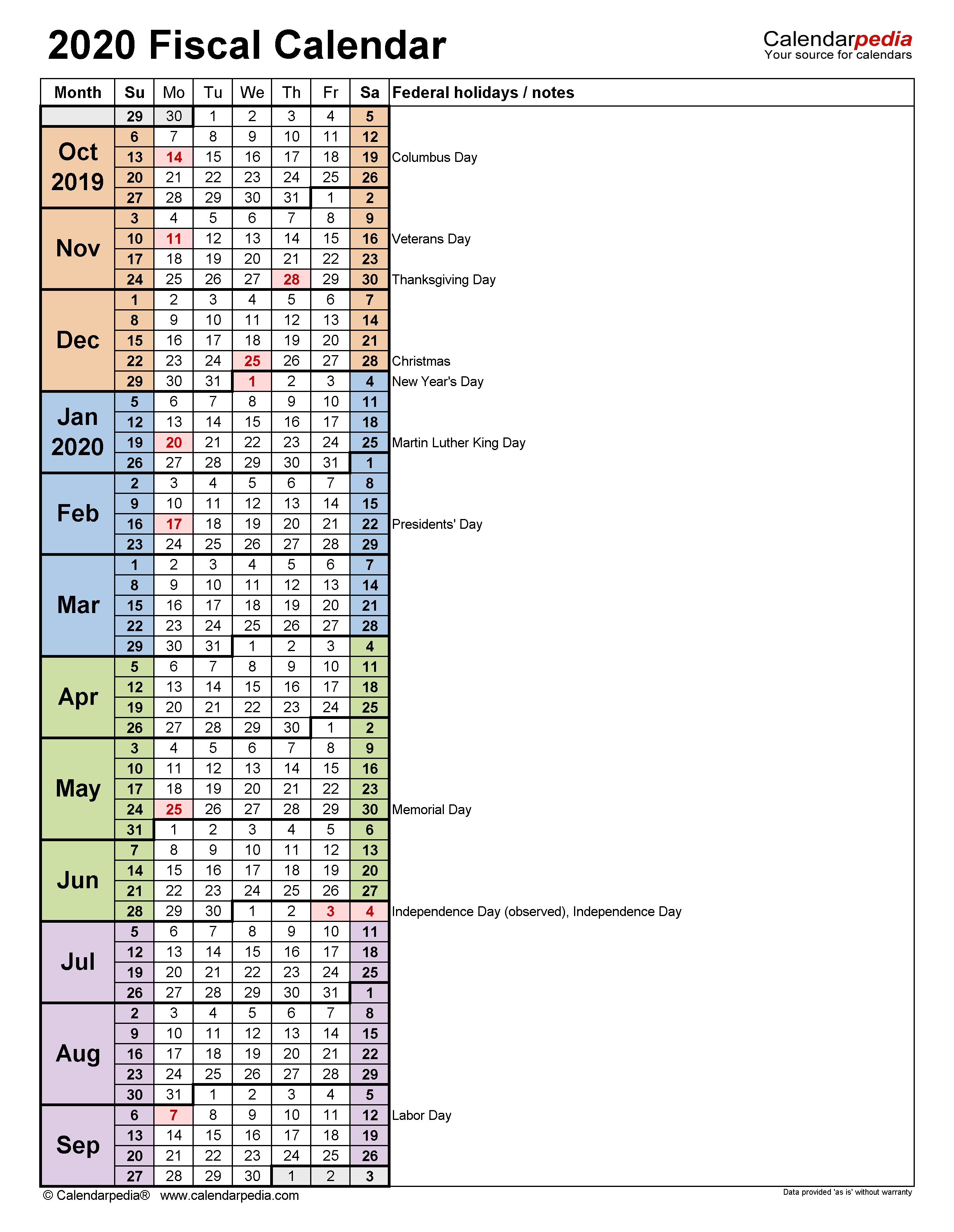

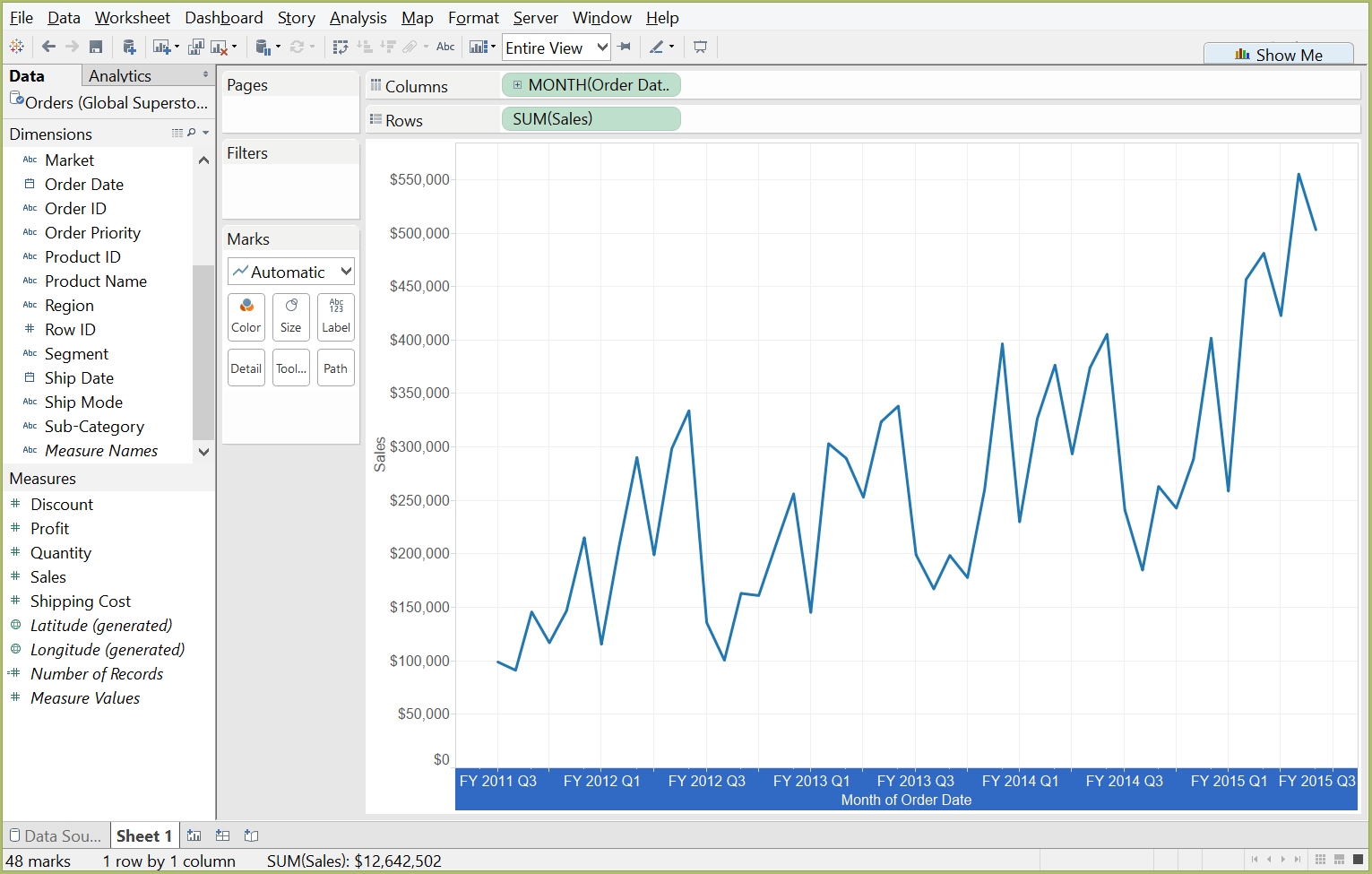

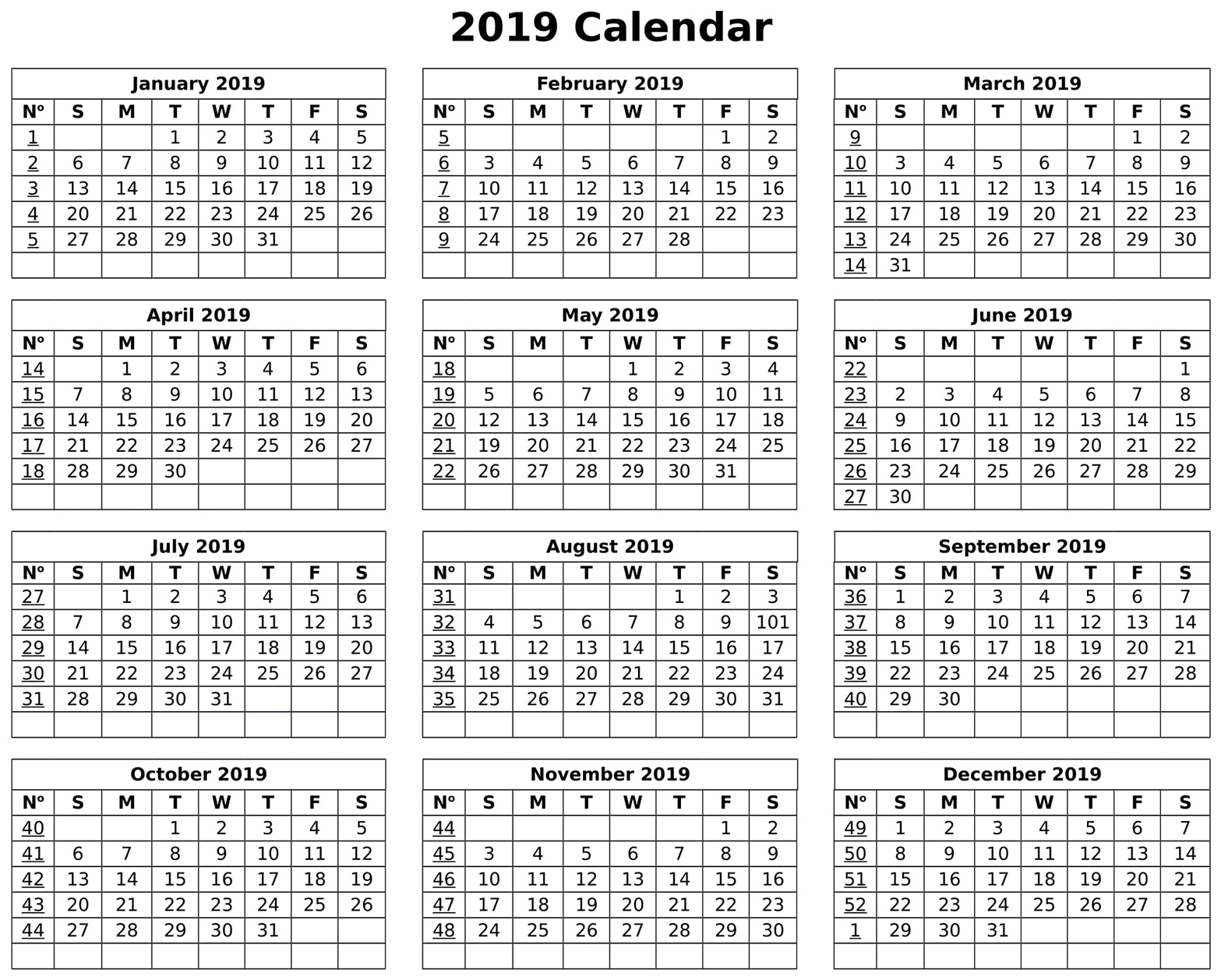

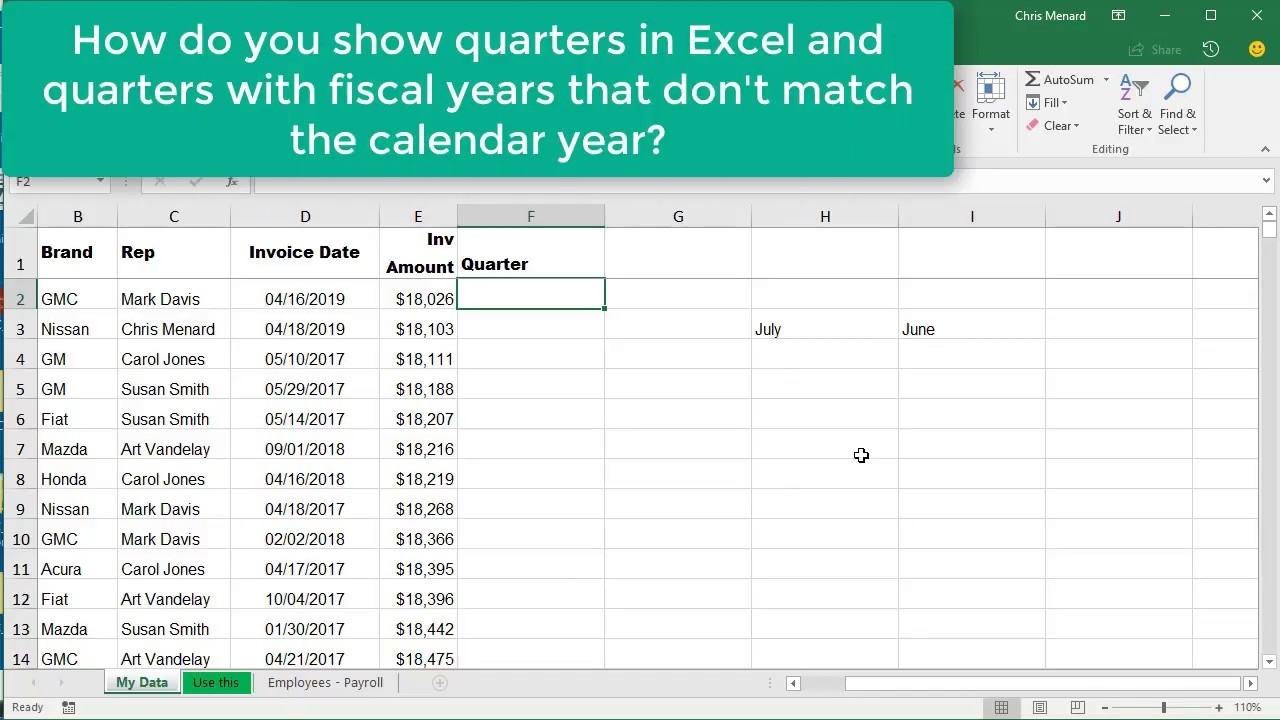

Fiscal Year Vs Calendar Year. Organizations use fiscal year for financial reporting and budgeting. Both are early months compared to the calendar year. The end of the year signals the close of the current accounting period and the start of the next one. A fiscal year is designed to facilitate accounting procedures and financial reporting. Each fiscal calendar contains one or more fiscal years, and each fiscal year contains multiple periods. The calendar year in which a fiscal year ends tells you which fiscal year you are talking about.

Fiscal Year Vs Calendar Year. A fiscal year is determined by a company, business, or individual, and can start and end on any day. Each fiscal calendar contains one or more fiscal years, and each fiscal year contains multiple periods. Fiscal Year – FY: A fiscal year (FY) is a period that a company or government uses for accounting purposes and preparing financial statements. The calendar year in which a fiscal year ends tells you which fiscal year you are talking about. Like a calendar year, a fiscal year can be broken down into four quarters of three months. The end of the year signals the close of the current accounting period and the start of the next one.

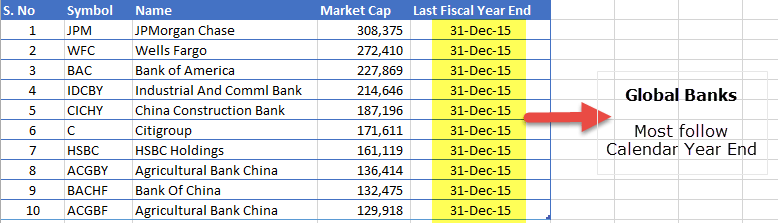

Some countries and companies base their fiscal years on the standard calendar year, while others follow a different fiscal year as determined by the government.

Fiscal Year – FY: A fiscal year (FY) is a period that a company or government uses for accounting purposes and preparing financial statements.

Fiscal Year Vs Calendar Year. A fiscal year may not be the same as a calendar year. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis of the adopted fiscal year. A fiscal year is designed to facilitate accounting procedures and financial reporting. It also has a period of twelve consecutive months. Both are early months compared to the calendar year. The end of the year signals the close of the current accounting period and the start of the next one.